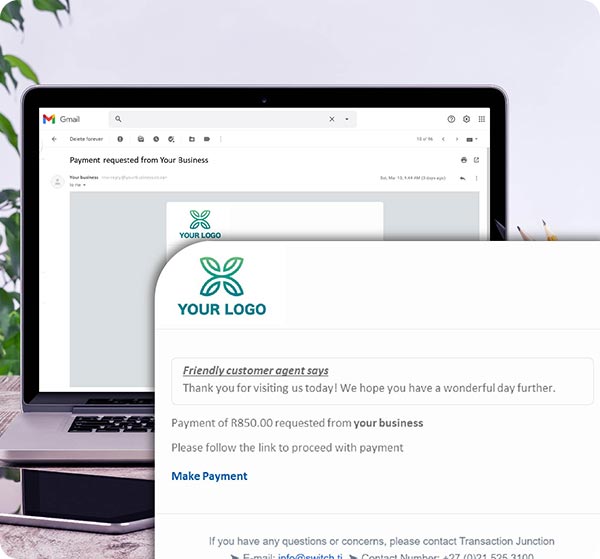

Our industry-leading integrated payment platform provides our merchants with complete peace of mind while enabling solutions that reduce cost, increase efficiency, and contribute to a seamless and modern customer experience.

We take care of the complexities of payment processing and provide an intuitive, real-time view of your payments, settlement reconciliation, and retail footprint.

Our solutions are device-agnostic, bank-agnostic, and enable an expanding ecosystem of ‘closed-loop’ and digital payment providers, all integrated directly to your point of sale.